KYC

Fintech companies need to balance their regulatory requirements for Know-your-customer regulations with the user-experience implications of enhanced data collection.

Bitaccess’s KYC software services are focused on ease of use, progressive data collection to allow Fintech companies to onboard new customers at high velocity, minimizing failed conversions, while maintaining industry leading data collection and verification.

PRODUCT INFORMATION

Bitaccess’s KYC software is designed specifically for fintech companies who need to quickly collect customer PII, and to segregate those customers based the amount of datapoints provided.

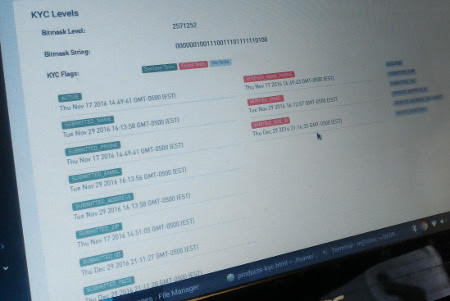

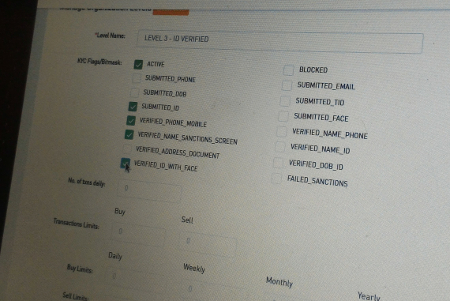

Our backend platform allows for fine grained groupings of customers based on collected information, and for transaction limiting based on these groupings.

Features

-

Sanctions Screening

Instantly compare customers against over 20 Sanctions and PEP lists.

-

API

RESTful API access to all wallet functionalities, NodeJS and Python clients are available.

-

ID Verification

Instantly verify identity document images from over 190 countries, with optional face matching

-

Admin Panel

Feature complete admin panel to mirror all API based actions for analysts and developers.

-

Support

Phone, email and SMS support is available for all wallet operators and end customers.

-

Volume Monitoring

Accurate, and highly detailed transaction volume monitoring based on daily, weekly, yearly and lifetime history.